We’re still within the pandemic crisis. While it sounds like some states will be lifting the stay at home orders, many Americans won’t fully participate in the economy like they did. We can expect more lost jobs and an extended recovery, if there will be a recovery at all.

So how should you invest in this market? I’m not going to tell you how to invest your money since I’m not your financial adviser but I’ll share how I’m investing mine. Hopefully you’ll find it useful while you develop your own financial plan!

First off, if you’re currently out of a job or in any way suffering economically right now, ONLY invest what is safe for your circumstances. Instead of investing money, now would be the time to invest in education and in yourself. I’m not hugely successful by any means but I make enough money for my family through my web design business and investments. I also know how to make money a variety of other ways so that even if web design went away tomorrow, I could provide for my family. No matter who you are, the main ingredients for making money are 1) Mindset 2) Knowlege 3) Work. There are tons of books on this subject if you’re interested.

My overall strategy

What spurred this topic is that looking at this current economy, I need to change my investment allocations. I currently have this blend of investments: 63.5% stocks & bonds, 15% land investments, 10% cash, 3.5% cryptocurrency, 3% REIT, 2.5% gold & silver, and 2.5% microloans. While this allocation provides some liquidity if I need it and diversification, it doesn’t match where the economy is right now.

With car and home repossessions on the rise right now, the microloans are not very secure. As my current microloans are repaid, I’ll move out of that investment class. Cryptocurrency offers an undervalued option to our fiat currency. If you haven’t heard the term ‘fiat’ before, it basically means the unbacked national currency. With the Federal Reserve continually making new money without any gold standard, there’s not much stopping wild inflation. So as a hedge against that, I see cryptocurrency raising in value, especially Bitcoin. I expect real estate to go down in value so I’ll be removing REIT’s from my stock portfolio but keeping my land (longterm value) and Fundrise account.

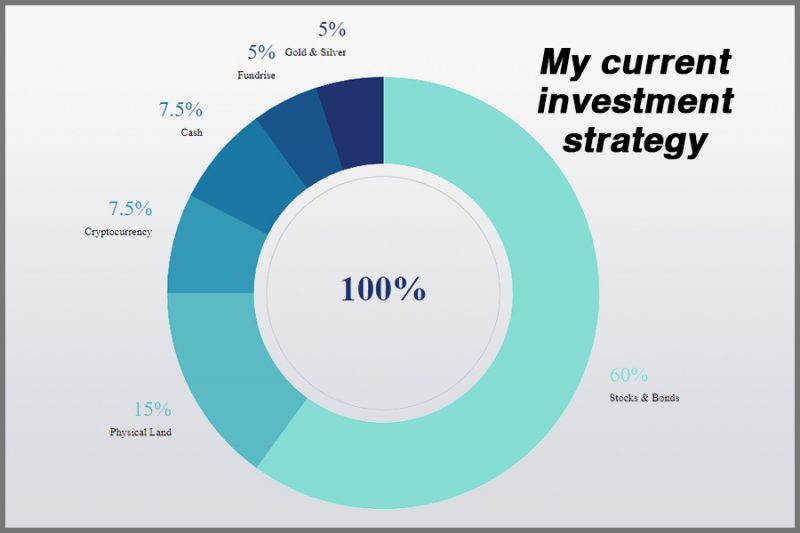

My new allocation

This is my new strategy and overall, it should grow in value much more than a high-yield bank account or CD. With the diversification, it should also provide some security. Again, this is my strategy and I’m sharing it here for educational purposes are you develop your own.

- 60% Stocks & bonds

- 15% Physical land (not including our residental home and rental)

- 7.5% Cryptocurrency (mainly Bitcoin)

- 7.5% Cash

- 5% Fundrise (basically a REIT)

- 5% Gold & Silver

My stocks & bonds allocation

Let me further break down my stocks & bonds portfolio, since that’s the bulk of my investment and is mainly tax deferred through retirement funds.

- 30% Utility ETF (VPU)

- 20% Short-term bonds (IGSB, AGG, TIP)

- 20% Tesla (TSLA)

- 10% Index (VOO)

- 10% Dividend ETF (SPHD)

- 10% Other

What you’ll notice here is that I’m pretty bullish on Tesla but also on moving the country from gas vehicles to electricity, hence the utility ETF play. Overall, I’m keeping 10% in index funds but I’ve moved more funds into short-term bonds at this time.

I hope this has been useful to you. Share if it has!